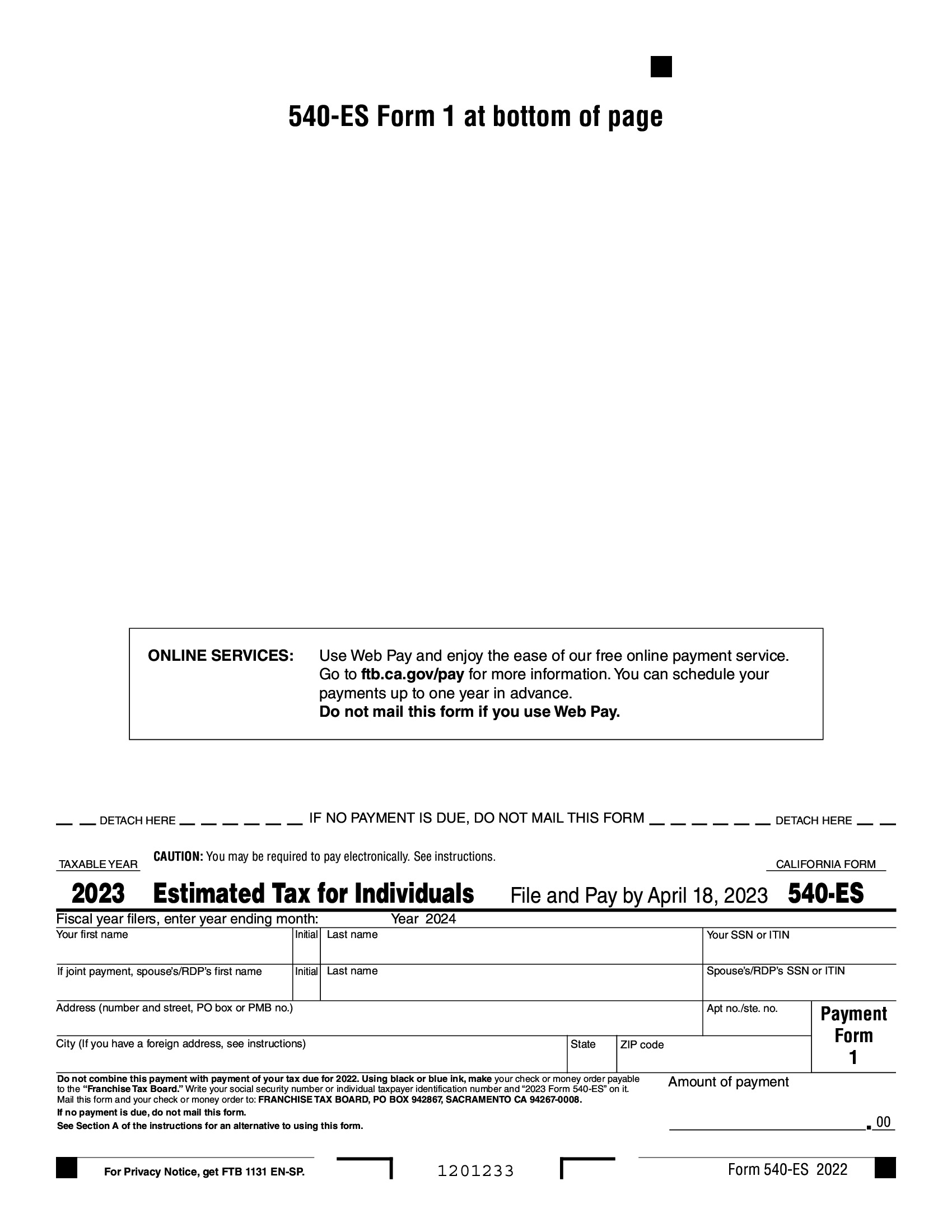

A California Christmas 2025 Quarterly Tax Form - Charlotte, nc / accesswire / june 20, 2025 / form 941 for the second quarter of the 2025 tax year is now available. 2025 New York State Tax Form Mabel Rosanna, Calculate your upcoming quarterly tax payment, with this free tool for freelancers. Credits you plan to take 2.

Charlotte, nc / accesswire / june 20, 2025 / form 941 for the second quarter of the 2025 tax year is now available.

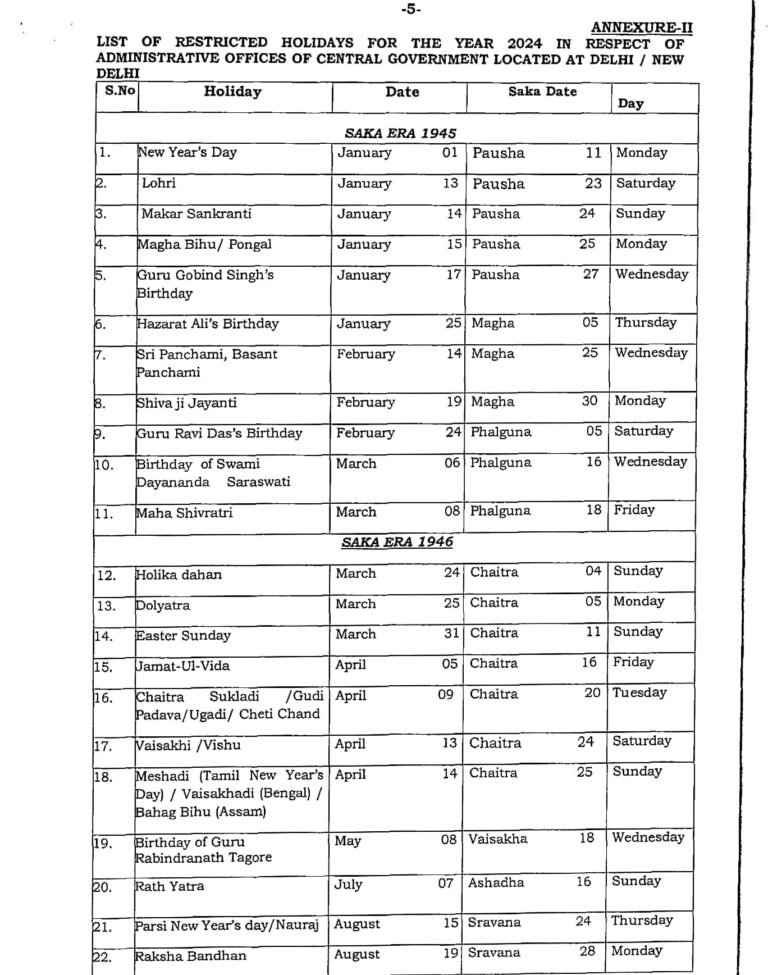

Central Government Holidays 2025 Holidays to be observed in Central, The due date to file your california state tax return and pay any balance due is april 15, 2025. 2025 2023 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025.

Quarterly Tax Payment Forms 2025 Edie Nettie, Thu, jun 20, 2025, 12:00 pm 5 min read. Irs and california quarterly estimated tax payment due dates for tax year 2025:

California Estimated Taxes For 2025 Due Dates Cynthy Martha, How to claim your tax credit. You’ll need to submit form 2210 to use this method.

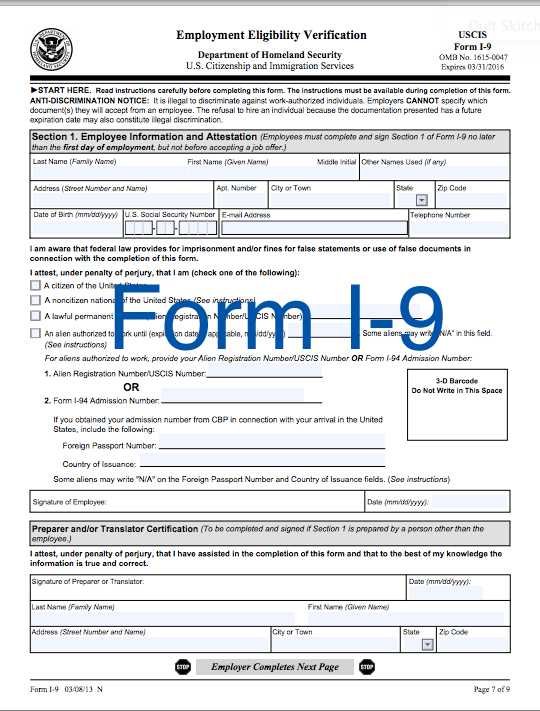

941s Fill out & sign online DocHub, Arvind kejriwal bail plea live lok sabha speaker election 2025 live stock market today nifty 50, sensex today top events today indian stock market income tax. Credits you plan to take 2.

To New Tech Gadgets For Christmas 2025 Uk. Sony playstation 5, £410 at amazon.co.uk. What are the best tech gifts…

Try keeper’s free quarterly tax calculator to easily calculate your estimated payment for both.

2025 4th Quarter Estimated Tax Payment Gabey Shelia, A special summary of key new. California offers a standard deduction for taxpayers, which reduces your taxable income.

Tax year updating this field may cause other fields on this page to be updated and/or removed.

However, california grants an automatic extension until october 15, 2025 to file. Irs and california quarterly estimated tax payment due dates for tax year 2025:

California Form 540 Es 2023 Printable Forms Free Online, Charlotte, nc / accesswire / june 20, 2025 / form 941 for the second quarter of the 2025 tax year is now available. Thu, jun 20, 2025, 12:00 pm 5 min read.